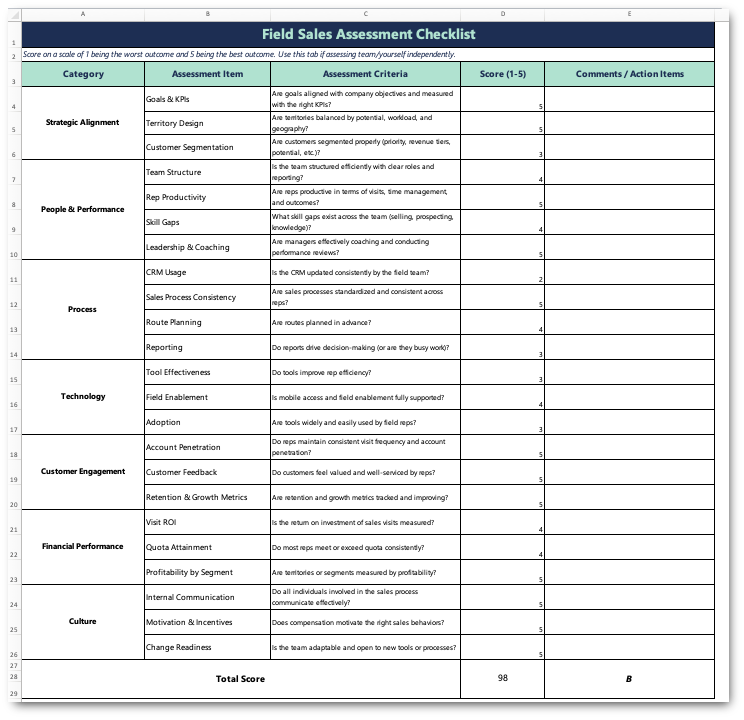

A field sales assessment unveils what’s working, what’s falling through the cracks, and where money might be getting left behind on sales calls. Download the spreadsheet to get started with auditing your performance and continue reading to see why a field sales assessment serves a critical role in driving growth.

The first thing to know is if your goals and the way you measure them actually line up. A common mistake is setting revenue targets without considering a team’s actual capacity or the market’s true potential. Balanced territories make or break this alignment. They should be thoughtfully drawn so that workloads and resources align.

Strong territory design can lift territory coverage by as much as 17% by itself.

No matter how your team covers territories—by potential value, revenue tiers or simple A/B/C labels, etc.—you need to be sure it’s focused on the right accounts. Your highest‑volume “A” accounts deserve the lion’s share of visits and meaningful touches, while “B” and “C” segments can survive with less frequent coverage. High‑growth prospects should also get bumped up the queue even if they’re small today. Treating every customer the same ultimately blocks growth rather than enables it.

[Video] Watch RepMove's On-Demand Demo

No assessment is complete without peering into the org chart. Roles need to be clearly defined so people are not constantly stepping on each other’s toes.

Then there’s the more uncomfortable question: how productive is each rep, really?

The average outside sales rep averages 5 visits, while the bottom 10th percentile of reps average 2 visits and the top 10th percentile averages nearly 14 according to RepMove’s data.

Dig deeper than quotas and sales calls. How fast do opportunities move from first meeting to close? Is time in the field consumed by meaningful conversations or by aimless driving and paperwork? Look for skill gaps too: some reps are natural hunters but hate account management. Others know the product inside and out but freeze when prospecting.

Even the best people falter when the process is sloppy. Start with your customer relationship management system. Unfortunately, the acronym CRM is a dirty word to many field-based reps. That’s because many, if not most, companies try to force an inside sales-focused CRM on the field team. Then virtually none of them use it regularly. Why? The whole point of a CRM is to support reps’ ability to sell. A traditional CRM is made for reps at a desk with a computer, not a mobile device on the road.

Process consistency matters elsewhere too. Is there a defined set of stages between lead, opportunity, proposal, and close? Does everyone follow up after a meeting, or do deals silently disappear because someone “forgot” to follow-up?

Route planning too often gets overlooked. Poor routing drains fuel budgets and destroys efficiency.

Finally, dive into call reports. Know whether your reporting cadence adds value or just adds busy work at the end of the week that isn’t particularly accurate or insightful. Reports should prompt decisions, such as if you should rebalance territories, shift resources, or coach an underperforming team member.

Shiny software doesn’t guarantee results. Too many tools get purchased only to collect digital dust. Before making a decision on a new tool, check whether it talks to your current platforms. Is your mapping solution integrated with the CRM? Do quoting tools pre‑populate from account data, or do reps copy-paste across screens? Mobile access and offline capability are also no longer nice‑to‑haves for field teams. Solicit feedback from your reps: which tools save time and which add friction? Sometimes dropping a poorly adopted piece of tech is just as impactful as buying something new.

Revisit your visit frequency and account penetration. Are you seeing your top customers often enough to protect share of wallet? Are there regions or segments where competitors are gaining ground because you haven’t shown up in six months? Coverage goes beyond call volume. It needs to focus on purposeful engagement. Collect honest feedback from a handful of top accounts. Do they view your reps as trusted problem solvers or as drop‑in order takers? Don’t be afraid to hear hard truths because they often reveal the best opportunities.

Retention and growth metrics tell you if you’re nurturing relationships or churning through them. If churn is creeping up or repeat orders are stagnant, it might signal that your team is chasing new prospects at the expense of existing business.

An assessment isn’t complete without looking at the financials. Calculate the cost per visit by combining travel expenses and time. Then compare that number to deal sizes and conversion rates. If you’re spending $200 in mileage and hours to close $500 deals, something’s off. Balanced territories and smarter routing will improve that equation.

Quota attainment and variance across territories are another lens. If only a handful of reps consistently hit quota while others fall short, examine whether territory potential, workload, and support are evenly distributed. Also, look at profitability by segment. Some customer types might generate healthy revenue but poor margins once travel and service costs are considered. You don’t need to abandon them entirely, but you might adjust service levels or pricing.

Culture keeps a field team moving in the right direction together. Do reps share insights, challenges, and wins? Do they live in separate silos? Is there a safe space to admit when a territory design isn’t working? Motivation and incentives also matter. Compensation plans drive behavior. If everyone is rewarded solely for new business, don’t be surprised when retention suffers. Mix in measures for nurturing existing accounts, cross‑selling, and even following process consistently.

Change is hard, even when it’s needed. Gauge your team’s readiness before rolling out new tools or territory realignments. Involve them in the design. Communicate not just the what, but the why. Once people understand the problem and have a hand in the solution, adoption skyrockets.

Conducting a field sales assessment is a lot of work, but it’s far less expensive than losing accounts through neglect or burning out your best reps.

If your assessment uncovers bigger opportunities, like unbalanced territories, inefficient routes, or reps struggling in admin, the right tool can fill the gaps quicker than you might imagine. While some traditional CRMs take engineering teams and hundreds of thousands of dollars to get off the ground, the next generation of modern field sales software works virtually out-of-the-box. RepMove is purpose made for field sales. It was built by people who lived the field rep life. Whenever you’re ready to take your field sales assessment from a one‑off exercise to an ongoing competitive advantage, reach out to RepMove’s sales team.